mississippi income tax calculator

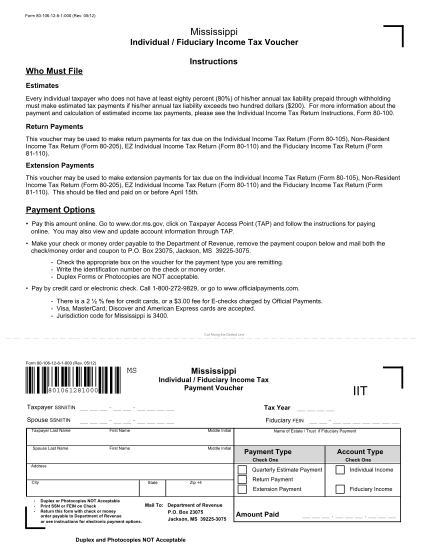

The process is simple. Mississippi Income Tax Calculator How To Use This Calculator You can use our free Mississippi income tax calculator to get a good estimate of what your tax liability will be come April.

Mississippi State Income Tax Ms Tax Calculator Community Tax

The rate increases with income in between.

. This Mississippi hourly paycheck calculator is perfect for those who are paid on an hourly basis. See What Credits and Deductions Apply to You. Mississippi Income Tax Calculator 2021 If you make 100000 a year living in the region of Mississippi USA you will be taxed 19594.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. If someone makes less than 5000 they pay a minimum of 3. Information on Available Tax Credits.

Your average tax rate is. Change state Check Date General Gross Pay. Create Your Account Today to Get Started.

After a few seconds you will be provided with a full breakdown of the tax you are paying. You can choose an alternate State Tax Calculator below. Select the rigth Pay Period Start ezPaycheck application click the left menu Company Settings then click the sub menu Company to open the company setup screen.

The higher income Mississippi taxpayers bring in. Enter your info to see your take home pay. Thankfully our Mississippi state tax calculator is a simple accurate way to calculate your tax liabilities in the Magnolia state.

Mississippis income tax ranges between 3 and 5. Click image to enlarge Set up company tax information option. Your average tax rate is.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. Enter Your Tax Information. All you have to do is enter each employees wage and W-4 information and the calculator will process their gross pay deductions and net pay for both Mississippi and Federal taxes.

Mississippi Income Tax Calculator - SmartAsset Find out how much youll pay in Mississippi state income taxes given your annual income. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Customize using your filing status deductions exemptions and more.

Ad Free Tax Calculator. The MS Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MSS. To use our Mississippi Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Year Month Biweekly Week Day Hour Results Salary Before Tax 0 Salary After Tax 0 Total Tax 0 Average Tax Rate 0 US Dollar 0 Net Pay 0 Total Tax. The state uses a simple formula to determine how much someone owes. The Mississippi tax tables here contain the various elements that are used in the Mississippi Tax Calculators Mississippi Salary Calculators and Mississippi Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers.

Mississippi Paycheck Calculator - SmartAsset SmartAssets Mississippi paycheck calculator shows your hourly and salary income after federal state and local taxes. Mississippi Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Box 23050 Jackson MS 39225-3050. Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 100000 and 500000 youll pay 3 For earnings between 500000 and 1000000 youll pay 4 plus 12000 For earnings over 1000000 youll pay 5 plus 32000. The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Mississippi State Income Tax Rates and Thresholds in 2022.

The graduated income tax rate is. Please make sure you select the correct Pay Period there. All other income tax returns P.

If someone makes more than 10000 they pay a maximum of 5. Our Mississippi State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 20000000 and go towards tax. 0 on the first 4000 of taxable income.

4 on the next 5000 of taxable income. Tax Rate Income Range Taxes Due 0 0 - 4000 0 within Bracket 3 4001 - 5000 3 within Bracket 4 5001 - 10000 4 within Bracket 5 10001 5 over 10000. Ad Find Recommended Mississippi Tax Accountants Fast Free on Bark.

Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Mississippi paycheck calculator. Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 Income Tax Regulations Title 35 Part III Mississippi Administrative Code. While this calculator can be used for Mississippi tax calculations by using the drop down menu provided you are able to change it to a different State.

The chart below breaks down the Mississippi tax brackets using this model. 3 on the next 1000 of taxable income. Any income over 10000 would be taxes at the highest rate of 5.

Mississippi Income Tax Calculator 2021 If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. Mississippi Income Tax Calculator Find out how much your salary is after tax so you can have a better idea of what to expect when planning your budget 9 Ratings See values per.

On the next page you will be able to add more details like itemized deductions tax. Switch to Mississippi hourly calculator. There is no tax schedule for Mississippi income taxes.

State Date State Mississippi. The Mississippi income tax calculator is designed to provide a salary example with salary deductions made in Mississippi. Mississippi uses a graduated income tax bracket system which means tax rates are structured according to income.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 5 on all taxable income over 10000.

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Mississippi State Ifta Fuel Tax File Ifta Online Ifta Tax

Mississippi Tax Rate H R Block

Mississippi Tax Rate H R Block

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi State Income Tax Ms Tax Calculator Community Tax

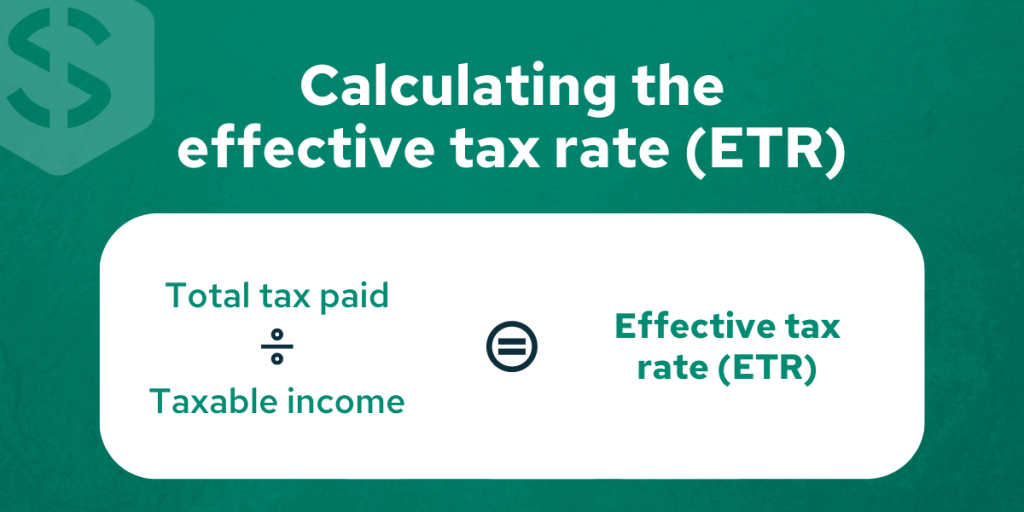

Effective Tax Rate 101 Calculations And State Rankings Savology

Minnesota State Income Tax Mn Tax Calculator Community Tax

1040 Tax Calculator United Mississippi Bank

Federal Tax Calculator 2022 23 2022 Tax Refund Calculator

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi Income Tax Calculator Smartasset

18 Income Tax Refund Calculator Page 2 Free To Edit Download Print Cocodoc

Mississippi Income Tax Calculator Smartasset

Mississippi State Income Tax Ms Tax Calculator Community Tax

Income Tax Calculator Estimate Your Refund In Seconds For Free

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price